Tariffs have caused a lot of commotion in the markets. They have experts warning of stagflation and recessions. Which has high-ticket items flying off the shelves.

But they’re also a long way from panning out. And, as visible as price increases can be, manufacturers are more resourceful than economists give them credit for.

So while tariffs can slow growth, it’s important to remember the economy is growing past many other things at the moment.

Excess Currency and Other Challenges

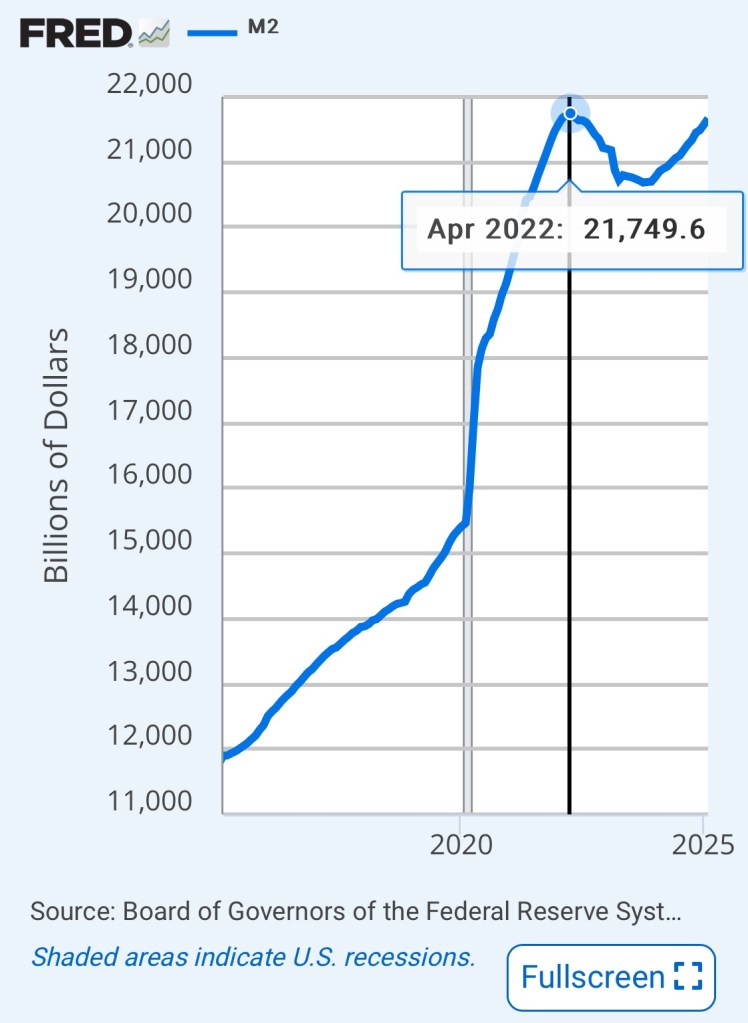

The biggest of those things is elevated values. Additional currency in the system from the COVID bailout increased the money available to spend (or M2).

(credit: Federal Reserve)

That in turn became too many dollars going after too few goods. This had a double impact: driving up inflation while boosting corporate revenues. And those increased revenues lifted asset prices for companies trading on major markets.

Jerome Powell’s Federal Reserve started to address this in March 2022. At the same time they started raising interest rates, they also began to tighten the money supply. It was something unknown for almost a generation after “Helicopter” Ben Bernanke and Janet Yellen bought Treasury bonds to pump M2 into the system.

And it would have worked, too, were it not for the Inflation Reduction Act. This heavy-handed attempt to force an energy transition on an unwilling public sent a lot of construction money to a lot of places where a lot of manufacturers never started production. We saw the consequences in a steady reduction of orders for American companies that has yet to level out.

What’s more, there’s still a national housing shortage. And now elevated material and labor prices make it hard to catch up.

What Worked Last Time

But we’ve faced high tariffs before. And we made it through ok.

In 2018 during the last trade war, I was a Facilities Engineer with a budget to manage. The normal 30-day windows to decide on outsourcing a job shortened to five back then. Something I see again now.

Frustrating? Sure.

But it only meant I had to make disciplined decisions faster. And we made our way to the other side of it. I don’t doubt front line supervisors will pull it off this time, either.

In the wider world, lower tax rates opened space for small business growth. That combined with information sharing made ownership more accessible than ever. The spike in business formations still hasn’t receded.

To be fair, a lot of things are missing since last time.

The “Venture Capital subsidy” that kept prices low on your favorite services, for example. You remember those cheap Uber rides and free grocery delivery? It helped innovative startups gain scale, but these companies had to grow past capital raises and start adulting to pay their bills.

Which means you’re paying for it now. On the bright side, we haven’t heard from hipsters in a while.

Interest rates were lower, too. This lowered risk for startups to take the leap. That surplus investment got workforce participation over 67% for the first time since the Clinton era.

And supply chain managers have had a long time to make changes post-COVID lockdowns. Having ships queued off the Port of Savannah for 80+ days was enough of a wake up call.

So challenges abound and some support is no longer there. But resourceful business owners always find a way.

Range of Outcomes

As I said earlier, we are working through everyone’s impressions of absolute uncertainty. The stock market gyrates wildly on news stories and social posts while official data releases have diminishing impact.

Yes, it’s still possible to see a worst-case scenario.

China could lock up better trade deals than the US or existing partners could walk away.

Orders would crater in that instance. And what orders manufacturers would get would be hard to make.

Worker quality and availability is still short. The COVID unemployment subsidy that paid $24/hour to do nothing at home swung a lot of expectations out of whack. Many people are walking away from good-paying manufacturing jobs after the first 2-3 days because a 12-hour shift is a challenge.

High interest rates could continue to suppress Main Street investment. It would free mega banks’ cash piles to consolidate ownership.

But what’s happening on the ground?

Hyundai’s new ad campaign started leaning into their domestic supply chain. Parts manufacturing facilities have boomed throughout the southeast. They’re putting on full display that they are resistant to price increases.

(credit: Hyundai)

The Durable Goods report for March was driven by orders for transportation equipment. Non-defense aircraft orders doubled. These companies are preparing for a lot more people and goods to move.

There’s still a lot of willingness to train new workers, especially ones with good work ethic. Companies still want to buy our stuff and American manufacturers have nowhere else to go. The ones who stick around have great opportunities ahead.

The best case of better deals and rising orders is taking shape.

Things to Remember

No matter how good or bad, no case will happen all at once.

Data still needs to catch up to expectations. If earnings and orders don’t drop like everyone expects them to, expect a sea change.

Orders looked solid last month. And earnings are holding steady.

(credit: VectorVest)

People also need to want to work again. There are plenty of opportunities and willing mentors who want to see manufacturing grow in the US. “Free” money getting squeezed out of the system gives me hope more people will see them.

That puts us back to climbing the wall of worry as tariffs pan out. After the drop we saw, that’s a good place to be. Especially when we have so many resourceful manufacturers to help us climb.

Want more thought leadership on manufacturing and the economy? Subscribe today and be the first to get my latest content.

If you enjoyed this article, check out these related posts:

2 thoughts on “My Take on Trump’s Tariffs”